How do I buy shares?

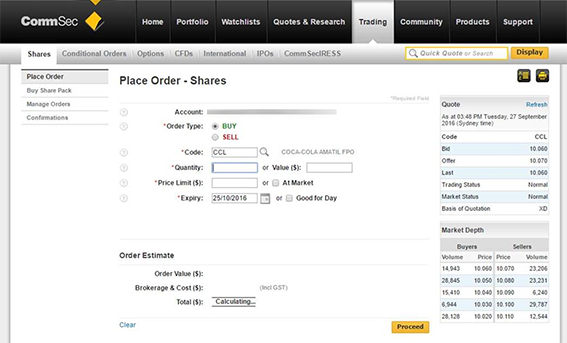

If you use an online broker like CommSec, the process of buying shares is quick and simple but there are still some important choices to be aware of.

Once you select a company and press ‘Buy’ you’ll be asked to choose what kind of order you wish to place.

The two main order types are:

- Market order

- Limit order

For market orders you specify the number of units and instruct the broker to buy them at the best available market price.

Share prices can fluctuate from one second to the next, so there’s no certainty what this price will be or how many shares you can buy or sell for the amount you choose to invest.

If your order is to buy shares, the broker will find the lowest available price and if your order is to sell shares, the broker will find the highest available price.

Limit order

A limit order gives you more control. Your broker will only execute an order at your chosen price or better.

Let’s say shares in a company are trading at $12 each and you think they’re going to drop slightly before an anticipated climb. You could place a limit order to buy shares at a price of $11.90, for example.

Alternatively, if you already owned the shares and thought they might rise in value before an anticipated fall, you could put a limit order in to sell the shares at $12.10, for example.

Knowing your limits

The difference between the bid and offer prices is known as the spread. If you place a market order, the broker will find the best available price to buy your shares but that might be above the current market price, meaning you’re paying a premium to the last traded price.

If you place a limit order, you can avoid paying that premium, or even get a discount to the current market price.

However, there’s no guarantee your order will be executed because share prices may not move as you expected and there may be no-one willing to sell to you or buy from you.

A limit order stays in the market until a designated expiry date and if it’s not executed by then, it’s cancelled.