What is distribution yield?

Similar to a dividend that is paid to company shareholders, you may receive distributions if you invest in Australian real estate investment trusts (A-REITs) or exchange traded funds (ETFs).

The distributions are a portion of the profit made by a trust or fund, distributed as income payments to investors, or unit holders.

This is one way that you can make money from such investments, as well as the potential for capital gains if the value of units in the trust or fund increases.

Capital gains and distributions combined make up your ‘total return’.

Distribution payments

Many ASX-listed A-REITs and ETFs will elect to pay distributions twice a year, usually declared half way through the financial year and at the end of the financial year.

Distribution payments are derived from the overall rental income and other gains from an A-REIT portfolio or from the collective dividends paid by the underlying shares within an ETF.

These distributions may be franked in the same way that dividends are and, like shares, units in an A-REIT or ETF will trade ‘ex-distribution’ from a certain date.

That means that anyone buying the shares or units on or after that date will not be entitled to previously declared distribution payments.

Understanding yield

A distribution yield is a measure of an A-REIT’s or ETF’s annual income payments to unit holders, as a percentage of its unit price.

- Average annual distributions over the last 12 months ÷ the current unit price x 100 = distribution yield

Distribution yield can be used as a measure of the income you receive relative to the size of your investment.

For example, an A-REIT trading at a price of $10 per unit which distributed $0.50 in distributions to unit holders in a year would have a distribution yield of 5%.

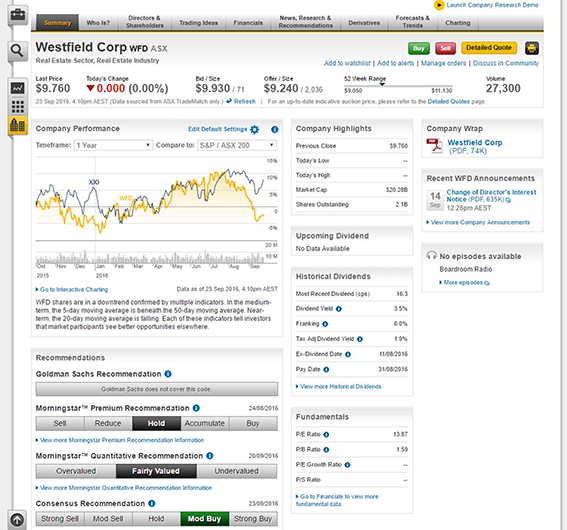

The distribution yield of an A-REIT is displayed as Dividend Yield in CommSec. In CommSec, go to Quotes & Research > Company Summary > enter the stock code you are looking for in the magnifying glass.