What is dividend yield?

Dividends are the portion of a company’s profit that it may decide to payout to shareholders, as opposed to retaining it to meet financial requirements or invest in new research, development, product launches or acquisitions.

Companies that pay dividends will generally do so twice a year.

The dividend yield is a very important ratio to look out for when analysing shares and the potential returns they could deliver.

It’s essentially the annual dividend per share, presented as a percentage of the share price.

- The average of the dividend over the last 12 months + broker consensus projected dividends (when available) for the next 12 months ÷ the current share price x 100 = dividend yield

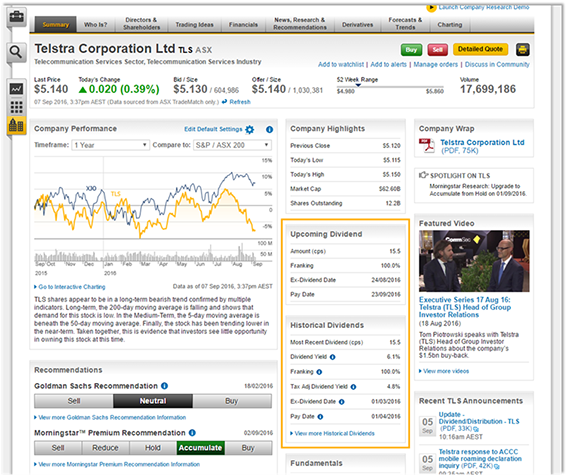

Most online brokers like CommSec will display the dividend yield. In CommSec, go to Quotes & Research > Company Summary > enter the stock code you are looking for in the magnifying glass on the left hand side of the page:

How they move

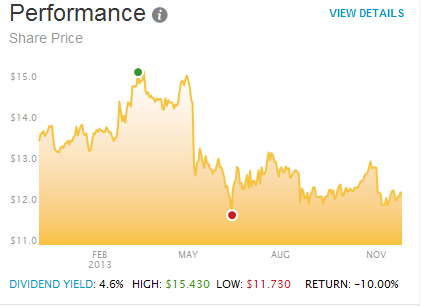

It’s important to be aware that share prices and dividend yields tend to move in opposite directions because if a share price suddenly jumps higher, then the dividends paid out will represent a smaller proportion of that figure.

Let’s say a company’s share price grows from $10 to $15, while the average of its paid and projected annual dividends is $0.50 per share. When the share price was $10, the yield would have been 5% (0.5 ÷ 10 x 100 = 5).

But when the share price was $15, the yield would have been 3.3% (0.5 ÷ 15 x 100 = 3.3), assuming the projections were unchanged.

Of course, a rising share price may be based on the perception that the company will increase its earnings in the future and that may lead to higher dividend payments to bring that yield back up.

However, remember that past dividends are no guarantee of future dividends.

Investing on the basis of high dividends alone is a dangerous tactic because a company with a sharply rising dividend yield may have suffered a share price fall and be unable to sustain their dividend payments in the future.

Dividend strategy

Although dividends can be a great source of return on investment, yields shouldn’t be directly compared to the rates of return on fixed interest or cash products, because shares always carry the risk of capital loss.

Whether you’re investing specifically for income to live off or to grow your initial investment over a long period, it’s best to consider both a company’s dividend yield and its potential for capital growth.

The combination of dividend income and capital growth is known as your total return.