What is shareholder return?

There are two ways that you can make money as a shareholder.

The first way is through capital growth, which occurs if the value of the shares you own rises between the time that you buy and sell them.

Secondly, some companies will use the profit they generate to pay dividends to shareholders as a reward for their investment.

When you combine the two, capital growth and dividends, you get total shareholder return.

- Total shareholder return = profit or loss from net share price change, plus dividends received over a given period

Shareholder return, as displayed on in CommSec, is calculated pre-tax and assumes that all dividends are reinvested.

What does total shareholder return tell you?

When you look at a company’s total shareholder return you can work out how much an investment would have risen or fallen over various time periods.

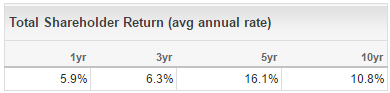

For example, the table below shows Commonwealth Bank’s shareholder returns over four different time periods, up to the end of August 2016.

It shows that an investment would have grown by 5.9% (or $590 on an initial $10,000) over one year, including capital growth and dividends. Over three years, the average annual return was 6.3% and over 10 years it was 10.8%.

While it can be useful to compare the total shareholder returns of two different companies that you’re thinking about investing in, don’t forget that past performance is no indicator of future performance and a company that performs well one year, may not repeat that the next year.

What else to consider?

When considered in isolation, shareholder return is no great help when choosing shares to buy. It’s always best to use a number of methods to assess the quality and value of a company.

Share price growth, for example, can be driven by many different things including investor expectations. But does the share price represent the true value of a company and its earnings potential?

With this in mind, you should also consider looking at a company’s price to earnings ratio, which will tell you how its share price relates to its ability to generate earnings, as well as enabling you to compare it to others in its sector.

Other useful measures to look at are earnings per share and dividend yield, while a company’s position in its market and its ability to grow in the future are also very important.