What is fixed interest?

Though they may not offer the largest potential returns, fixed interest investments can play a vital role in a well-balanced investment portfolio.

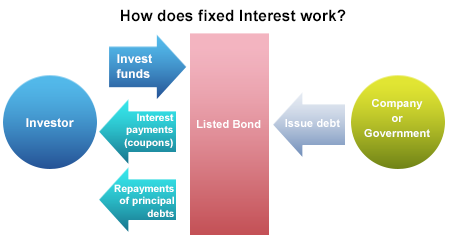

The most common type of fixed interest investment is bonds, which come in two main categories - corporate bonds and government bonds.

With corporate bonds you lend money to a company for a set period of time and receive interest payments at regular intervals in return.

You will either receive a fixed or floating rate of interest. A fixed rate means you receive the same amount of interest throughout the life of the bond, but with a floating rate of interest this may go up or down along the way.

On top of the interest payments, your initial investment will be repaid to you on a pre-determined date, known as the maturity date. This could be one, three, five, ten or more years in the future, depending on the bond.

Government bonds work in the same way but you’re likely to receive a lower rate of interest because lending to a government is considered safer than lending to a company.

What are the benefits?

The main benefit of bonds is the predictability of income that they can provide you with.

They tend to pay a higher rate of interest than cash investments.

Whereas shares and property are considered growth assets, fixed interest is more of a defensive asset, which basically means it is a safer option with more predictable returns.

For example, if you invest $1000 in bond that pays an interest rate, or coupon, of 3%, you would receive $30 a year.

What are the risks?

Some bonds are listed on the share market, which makes them easily accessible, but also means their value can rise or fall during their lifetime. This means that if you wanted to sell the bond before its maturity date, you may not get back the full amount that you invested.

If the rate of interest you receive is lower than the rate of inflation, then the value of your money would not actually be growing in terms of your spending power. But it’s important to consider the returns you get from your portfolio as a whole, not just from one asset.

In the event that the company or government that issues a bond runs out of money, you may not get back all that you invested. Were that to happen though, bondholders are repaid prior to shareholders.