CommSec

CommSec

30 October 2018

CommSec

CommSec

30 October 2018

The business cycle describes the upward and downward movements of the economy over time. Also known as the “economic cycle”1, it’s measured in terms of output of goods and services or Gross Domestic Product (GDP). Each cycle varies in length and amplitude, and it’s hard to observe business cycles when they’re happening. But a broad understanding of the business cycle can help you make more educated decisions about your investment portfolio.

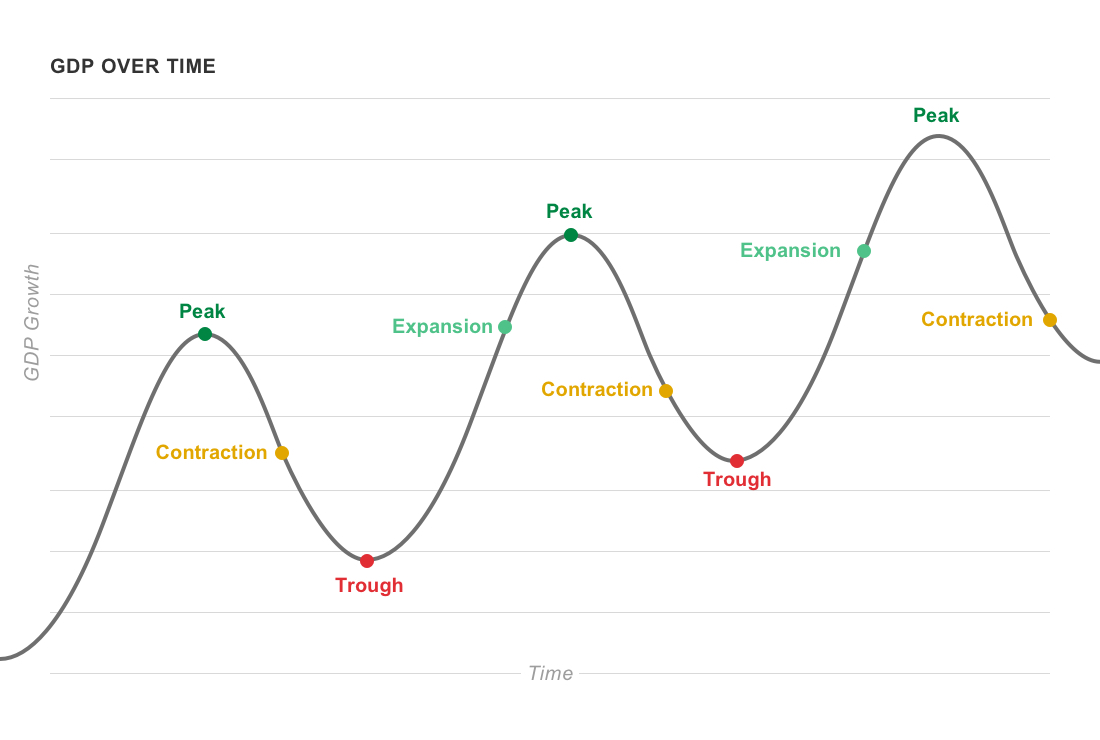

The textbook business cycle is generally seen as having four phases:

The time period from one peak to the next is considered to be a business cycle2. During periods of expansion, the share market is generally perceived to be in a bull market (people are buying shares in preference to other assets like bonds). During periods of contraction, the share market is generally perceived to be in a bear market (people are selling shares and buying other assets).

Some people assume that the business cycle indicates what will happen on the share market. But the share market is actually considered to be a leading indicator of the business cycle.

The reason for this is that investors need to look forward while economic indicators are generally backward-looking. Investors look forward to assess the outlook for company revenues and profits - and therefore the future value of share prices. Economic indicators look back at statistical data to provide a report on the economy’s health during a period of time.

When an investor decides how much they’re willing to pay for a share, they base that decision on what they think will happen to that share in the future. If they expect the economy to grow and share prices to go up, they will factor this into the share price they’re willing to pay today. This is why it’s generally thought that a bull market will peak before the economy peaks, and a bear market will end before the economy bottoms out.

Let’s say consumer spending has been robust over the last year. The Australian Bureau of Statistics (ABS) has reported its official numbers on retail turnover for the latest quarter, and it’s up 1.2% from the previous period. This is what’s known as an economic indicator, and in this example, it’s showing positive growth in consumer spending for the period.

However, what if there was a shift in interest rate policy during this period, or changes in lending criteria that will adversely affect consumers? Even though the economic data looks good, investors in consumer shares would be looking forward to how the interest rate or lending policy change might affect their shares. They would react based on their expectations about a future downturn.

In this scenario, investors may sell some of their Consumer staples/discretionary shares. If many investors shared the same view, this could potentially cause a decline in share prices in this sector. So even though economists are saying that consumer spending is growing, the current state of the share market would tell a very different story.

Getting to know the business cycle is useful because some investors may use it to try to time their entry to or exit from the market. The theory is that you could make a gain by buying shares when prices are depressed, and selling them when prices have recovered. But timing the market is very hard to do in practice. It’s easy to recognise a peak or a trough after it has already happened, but trying to predict one is another matter entirely. For many investors, the better approach over the long term could be a buy-and-hold strategy or making many small purchases over time.

Even if you’re not trying to time the market, paying attention to the business cycle can still have benefits. Some investors will review their portfolio whenever they perceive that the business cycle is entering a new phase. For example, during a recession, an investor might adjust their portfolio to allocate more of their savings to bonds instead of shares. On average, bonds tend to be less volatile than shares, so the investor might feel that switching to bonds will lower their exposure to risk. When investors perceive that the economy is about to recover, the investor might switch back to shares, which tend to have a higher potential for growth of total returns when compared to bonds.

Watching the business cycle could also highlight specific investment opportunities. For example, in a domestic recession, it could be reasonable to expect that the Reserve Bank will push interest rates down to encourage businesses and individuals to borrow. As this cycle plays out in the share market, smaller companies (which are more growth-dependent) may be best positioned to take advantage of the early stage of a recovery.

[1] https://www.asx.com.au/education/glossary.htm

[2] https://www.investopedia.com/terms/b/businesscycle.asp

InvestSMART

InvestSMART

16 October 2018

There’s no such thing as an investment with a 100% guarantee on returns. That’s why it’s so important not to put all your eggs in one basket. But how do you pick the baskets?

CommSec

CommSec

20 August 2018

Trying to choose a company to invest in can be overwhelming, especially when you’re new to shares. Here are seven tips on where you can start your research.

Read more

CommSec

CommSec

3 August 2018

Sticking to an investment plan is the key to success for many investors. We look at why planning is so important, and how to write an investment plan that works for you.

Start trading today with Australia's leading online broker

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability.

This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast.

This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness.