CommSec

CommSec

21 June 2019

CommSec

CommSec

21 June 2019

Exchange Traded Funds (ETFs) are investment funds that trade just like shares, many with good liquidity and high transparency. ETF prices and underlying holdings are reported online from various providers on a daily basis.

Using ETFs in an SMSF can provide diversification, and give you access to different markets that may be difficult to invest in directly (e.g. international shares).

To buy or sell ETFs, you need an account with a broker like CommSec. The process is the same as with buying and selling shares. There is a wide variety of ETFs on offer, so the question often becomes “Which ETF should I buy to fulfil my investment goals?”

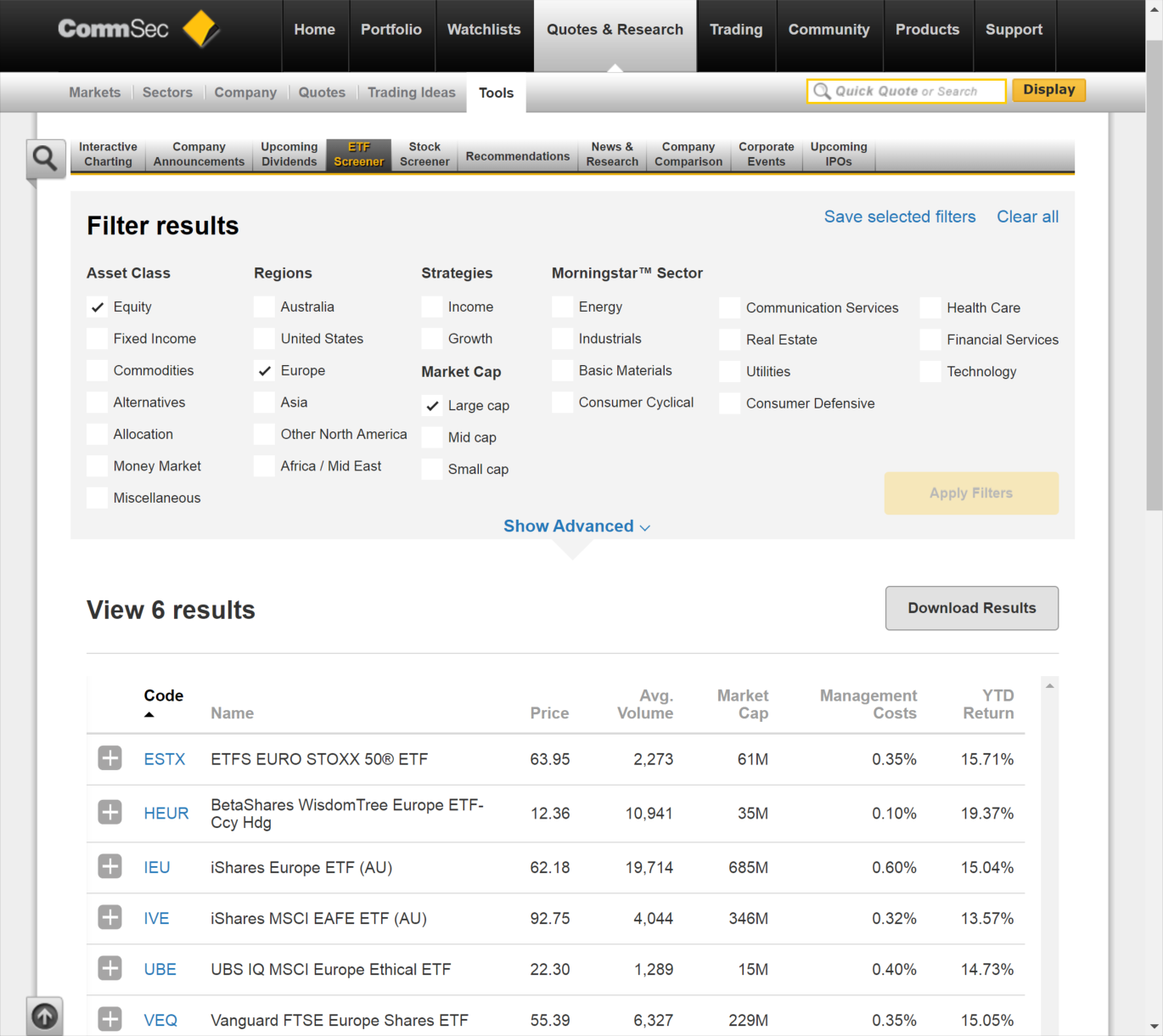

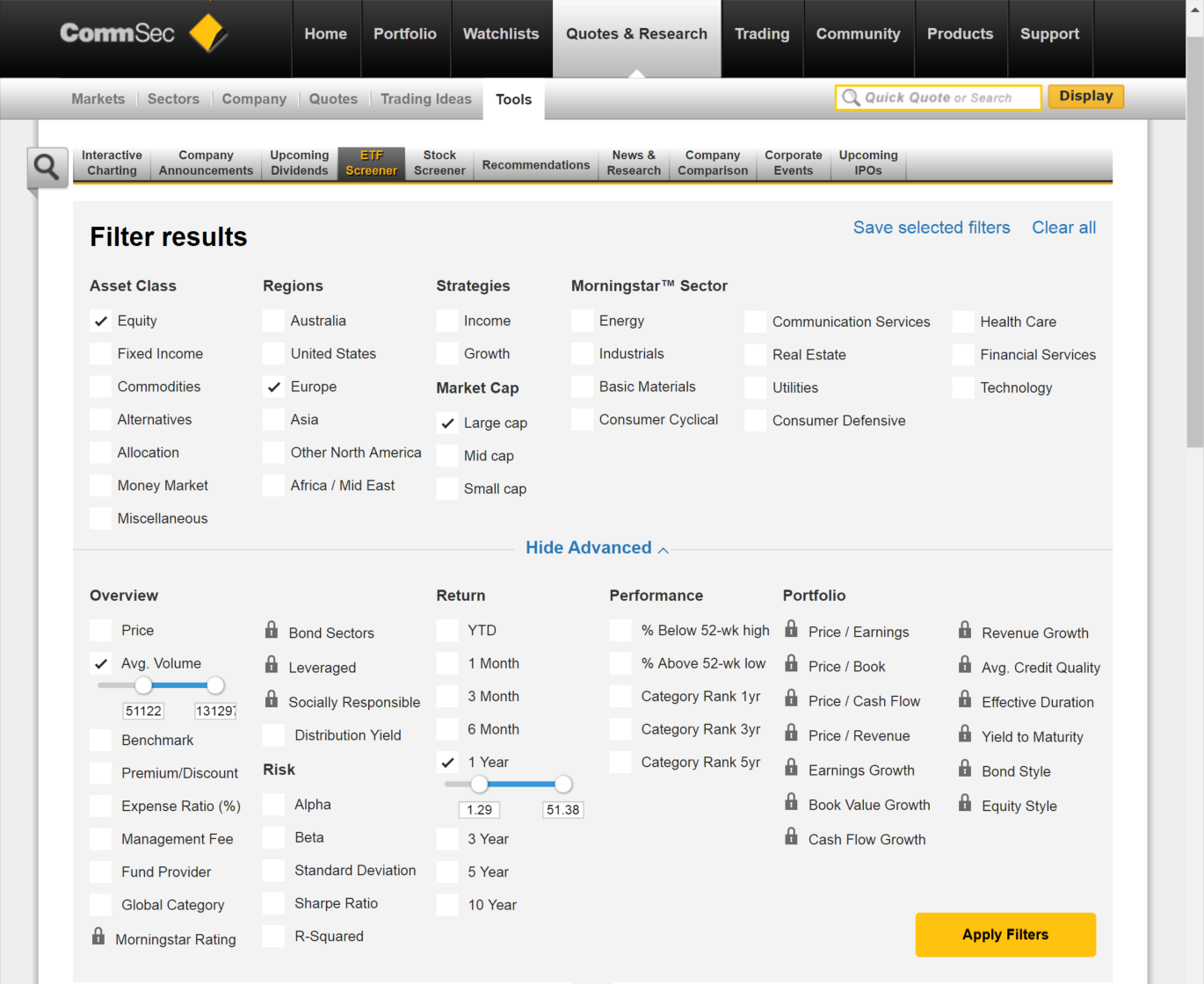

To help you find an ETF, many of the well-known brokers provide a screening tool. If you have a CommSec account, you can find the ETF screener by logging in and going to Quotes & Research > Tools > ETF screener. You can then select your relevant filters to narrow down your search to a shortlist of ETFs for further investigation. There are two filter levels – basic and advanced. The advanced filter gives you a greater ability to use financial metrics to fine tune your search.

Figure 1. The basic filter

Figure 2. The advanced filter

The ETF screener is a good tool to provide you with a shortlist for further research. Next, you should review each ETF to ensure you understand the underlying components, risks, and strategy of the fund. CommSec provides a range of data on the fund’s objectives, performance returns, and holdings. For more information, you can visit the ETF issuer’s website and have a look at the product fact sheets.

ETFs have an open-ended structure. This means that units of an ETF can be created or redeemed by “market makers” (unlike normal shares, which have a fixed number of shares on issue). Therefore, the market depth or liquidity of an ETF doesn’t relate directly to the units quoted in the “market depth” section of your broking screen. This ability to create and redeem units means ETFs are more liquid than they may appear. The liquidity of an ETF is mainly determined by the holdings of the fund.

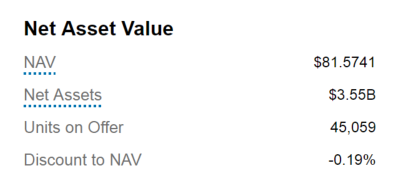

The NAV is the estimated intra-day "fair value" of the ETF (which is the price per unit of the basket of underlying securities held by that particular ETF, less any liabilities such as management fees). This NAV figure updates multiple times per minute, which means ETF prices are relatively transparent compared to unlisted managed funds (which are usually only priced once a day, at the end of the trading day).

The NAV for ETFs can be found on the CommSec website. Log in, go to Quotes & Research, and type in the relevant ASX code. In the fund’s Snapshot, you’ll find a section about Net Asset Value that looks like this:

Exchange traded funds are subject to bid and offer spreads. This is the difference between the NAV and the price at which the ETF can be bought or sold on the ASX. In general, the more liquid the security, the tighter the spread. Bid/offer spreads for all ETFs can be found on the CommSec website under Quotes & Research, Watchlists, or when placing a trade.

When you place an order through CommSec, you have the option of placing your trade as a "market order" or a “limit order”. A market order means you are agreeing to bid on whichever price the market is willing to pay, while a limit order means you can specify the price you are willing to bid.

The risk with a market order is that if there are many orders placed at the same time, your trade may be filled with the next best market bid (which may be worse than the best price possible).

To avoid this, you could place a limit order. With a limit order, you may run the risk of your order not being filled immediately, but you still avoid the risk of getting a price worse than what you wanted.

Some investors avoid trading ETFs close to the market open and close. This is because the prices of the ETF’s underlying securities tend to fluctuate more at these times, and this may result in wider than normal spreads. This volatility occurs around the market close as the "matching period" approaches (all trades that take place when the market closes will transact at a price determined by the market, regardless of what price an investor bids or offers).

SMSFs can invest in active ETFs as well as index ETFs (which are a form of passive investing). Active ETFs use various strategies to provide an active element in stock selection. They are more convenient to buy and sell compared to unlisted managed funds, because they’re listed on the ASX. And in many cases, they are cheaper.

The Australian ETF market continues to grow, and ETFs can offer real benefits in terms of cost and ease of diversification within your overall investment strategy. But before you invest in any fund, you still need to do your homework to ensure you understand the underlying components.

CommSec

CommSec

10 May 2019

Find out how SMSFs can be used to give your SMSF diversity and access to other asset classes, including alternatives. Plus, learn how SMSFs can be used for a variety of investment strategies.

CommSec

CommSec

15 April 2019

Alternative investments can be unfamiliar territory for many everyday investors. Read on to find out some of the benefits and risks of investing in alternatives through a Self-Managed Super Fund (SMSF).

CommSec

CommSec

25 February 2019

Self-managed super funds can be an attractive option for some investors. But for others, the effort of running a fund might not be worthwhile. Find out what’s involved in running your own SMSF.

Start trading today with Australia's leading online broker

This article is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. Past performance is not an indication of future performance. Investors should consult a range of resources, and if necessary, seek professional advice, before making investment decisions in regard to their objectives, financial and taxation situations and needs because these have not been taken into account. Taxation considerations are general and based on present taxation laws and may be subject to change. You should seek independent, professional tax advice before making any decision based on this information. Commonwealth Bank is also not a registered tax (financial) adviser under the Tax Agent Services Act 2009 and you should seek tax advice from a registered tax agent or a registered tax (financial) adviser if you intend to rely on this information to satisfy the liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law. Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned, but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability.