CommSec

CommSec

20 December 2018

CommSec

CommSec

20 December 2018

Deciding when to invest isn’t an easy process for a lot of us. First there’s the issue of where to get stock ideas. Then it’s time to research a stock to work out whether the investment opportunity matches your goals.

Let’s say you’ve done your research, and you believe the stock you’ve chosen may be a sound investment. What next?

You might feel an overwhelming desire to jump in straight away, or maybe you’re the total opposite (reluctant to commit). You might feel good about a stock, but not completely confident that now is the right time (or the right price) to invest in this particular company.

One way to manage all these emotions is to develop a personal process using tools to help you decide when to buy a stock. CommSec provides a range of tools to help you establish your process – and we’ll cover off our top three tools below.

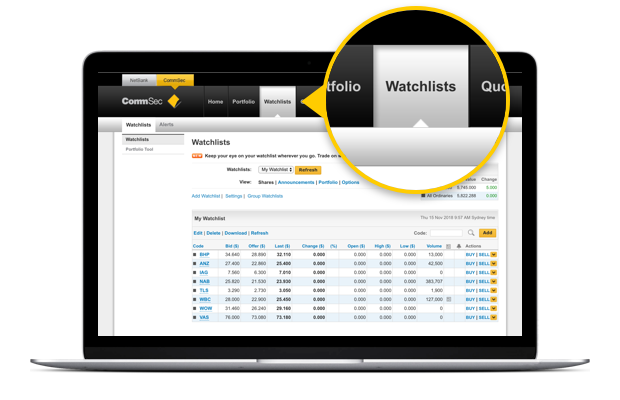

A watchlist is a way to keep of track stocks you’re interested in. If you’ve researched a company and you’re considering buying its shares in the future, the next logical step is to add it to a watchlist.

Watchlists can help you get in the habit of being an active investor. They prompt you to check the stock’s performance on a regular basis and stay focused on the companies you’ve researched.

Adding a stock to a watchlist also keeps you updated on any announcements made by the company. You can look at what happens to the stock price after an announcement about the company’s performance or a recent business development.

Over time, you might start to build an understanding of the relationship between the company’s stock price and market conditions.

You can also manage your watchlists from the CommSec Mobile App.

Watch the video to find out how to set up and manage your watchlists.

Alerts can help you keep a close eye on what’s going on with a stock price. As you get familiar with the price movements of a company in your watchlist, you might start to develop an idea of how much you’d be willing to pay for a share. You can then create an alert to notify you if the share reaches the price you’d be comfortable with.

For example, say you found a company you’d like to invest in, and you’d be willing to pay $68 per share. The stock is currently trading at $70 per share, which you think is too high. So you set up an alert to notify you if the stock drops to $68 or below. If you receive an alert that the stock has reached your target price, you can review your research and consider whether you still think $68 is a fair price. If it is, you might go ahead and make a purchase.

You can also create alerts to notify you when a company makes a market sensitive announcement, or when a stock goes ex-dividend. These can help you keep track of your existing investments as well as prospective ones.

To create an alert:

Step 1: Log into your CommSec account and select Watchlists

Step 2: Select Alerts in the tab menu

You can also access your alerts via the main menu in the CommSec Mobile App.

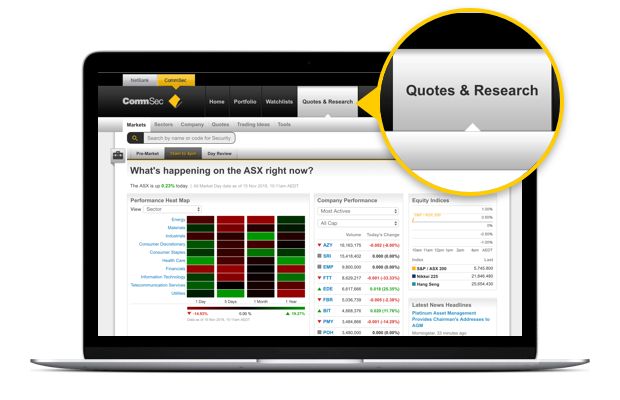

Price charts can be used as a complementary tool when you’re exploring an investment opportunity. They might help you confirm beliefs you have about the direction of a share price. If you’re considering buying a stock, you can review its price history over a medium to long-term timeframe to see whether the chart shows any trends around the share price. For example, if the price is steadily going down, you might decide to wait until the direction changes before you buy the stock.

CommSec provides a suite of sophisticated charting tools that you can use to compare stocks and track their performance.

To access charting:

Step 1: Log into your CommSec account and select Quotes & Research

Step 2: Search for a company

Step 3: Select Charting from the horizontal menu

As an investor, you can equip yourself with a range of tools to help you decide when to invest in a company. Using these tools, and developing a process to evaluate opportunities, is essential in becoming a more disciplined, informed investor.

Start trading today with Australia's leading online broker

Important Information

This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast.

This article is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. Investors should consult a range of resources, and if necessary, seek professional advice, before making investment decisions in regard to their objectives, financial and taxation situations and needs because these have not been taken into account. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. Past performance is not indicative of future performance. Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned, but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability.