CommSec

CommSec

20 December 2018

CommSec

CommSec

20 December 2018

Finding new opportunities is one of the big challenges of investing. We’re regularly bombarded by huge amounts of news, research, and financial information. And with over 2,000 companies listed on the ASX alone, how do you figure out what companies are best placed to meet your investment goals?

There’s not much point in researching a company if it doesn’t match your objectives. So the first step in filtering stock ideas is to reflect on your investing goals and strategy. Once you know whether you’re looking for income or growth, how much risk you’re willing to take, and what your timeframes are, you can start to refine your research. For example, if you’re looking for exposure to short-term performance, you could focus your research on growth companies. Or if you’re looking for investments that provide income, you could focus on established businesses with a healthy dividend policy.

If your goal is to build wealth gradually, rather than buying and selling frequently, you might be a passive investor rather than an active one. In this case, a form of passive investing such as Exchange Traded Funds (ETFs) could be worth exploring.

When you use your strategy as a guide, you might miss out on high-performing companies that don’t match your research criteria. But if you’re focused in your research criteria, the investments that you choose may be more likely to provide you with your desired return. Find out more about how to research a stock before you buy.

A stock screener can be incredibly helpful for an investor looking to discover investing opportunities. It allows you to select your investment preferences or goals, and then search for a list of the companies that meet your criteria.

With CommSec, you can access a comprehensive Stock Screener on our website:

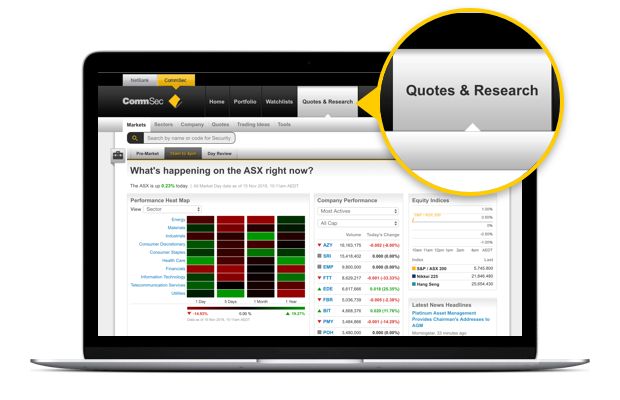

Step 1: Log into your CommSec account and select Quotes & Research

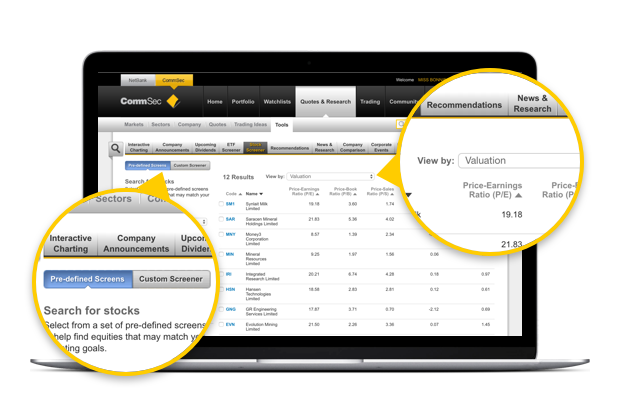

Step 4: Run a predefined or custom search

Step 2: Select Tools

Step 3: Select Stock Screener in the tab menu

You can nominate custom filters, or run a predefined search to find companies that meet certain investing objectives (e.g. growth or income). You can filter the results by recommendations or dividends, as well as a wide range of financial ratios and indicators.

For example, if you want to invest in technology stocks and you’re looking for large companies that pay regular dividends, you could use the stock screener to search for companies that:

The stock screener results would give you a list of companies that match your criteria, and you can then research these companies further to work out whether they match your goals.

Find out more about what tools you can use to research and compare stocks.

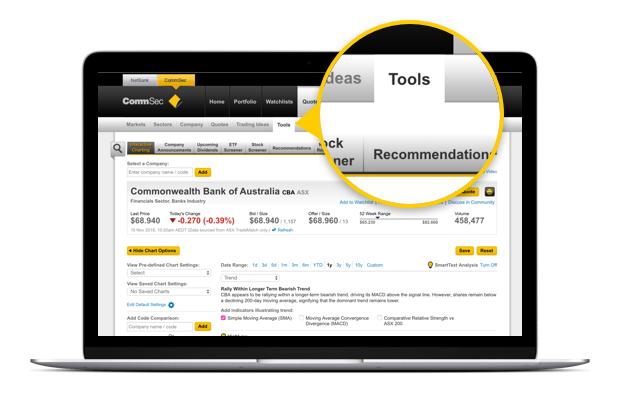

Independent research providers like Goldman Sachs and Morningstar regularly publish recommendations to buy, hold, or sell particular stocks. CommSec customers can view the latest recommendations by logging in and going to Quotes & Research > Trading Ideas.

You can filter the recommendations by market cap, sector, or type of recommendation. For example, if you want to invest in the health sector, you could search for healthcare companies that were recently upgraded to a “Buy” recommendation, and use that as a starting point for your research. Every recommendation has a report attached to it – you can read these for context on why the research provider has made their recommendation.

Investing is about running your own race, and you should choose investments because they align with your goals – not just because everyone else is buying or selling a particular stock. However, it’s often interesting to look at what other investors are trading, and this can be a good way to gauge the current market sentiment.

Every week, CommSec publishes a list of the top 20 traded Australian shares and the top 20 traded international shares. These lists can be a useful place to start your research, or to get a current snapshot of what’s happening in the market.

CommSec provides a broad range of market reports and research to keep investors up to date and help you identify your next investing opportunity.

You can also keep an eye on the general financial press, like newspapers, blogs, and newsletters. This will help you stay on top of your investments and learn about other views from industry experts.

If you’re already doing these things but you’re still not sure what to invest in, don’t worry. There’s a lot of information out there, and it takes time to get to know the share market. Keep reading, researching, and watching the market. The more you learn, the better equipped you’ll be to spot the right investment opportunity for you when it comes along.

Start trading today with Australia's leading online broker

Important Information

This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast.

This article is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. Investors should consult a range of resources, and if necessary, seek professional advice, before making investment decisions in regard to their objectives, financial and taxation situations and needs because these have not been taken into account. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. Past performance is not indicative of future performance. Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned, but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability.